As banks around the world prepare to replace many thousands of workers with AI, Australia's biggest bank is scrambling to rehire 45 workers after allegedly lying about chatbots besting staff by handling higher call volumes.

In a statement Thursday flagged by Bloomberg, Australia's main financial services union, the Finance Sector Union (FSU), claimed a "massive win" for 45 union members whom the Commonwealth Bank of Australia (CBA) had replaced with an AI-powered "voice bot."

The FSU noted that some of these workers had been with CBA for decades. Those workers in particular were shocked when CBA announced last month that their jobs had become redundant. At that time, CBA claimed that launching the chatbot supposedly "led to a reduction in call volumes" by 2,000 a week, FSU said.

But "this was an outright lie," fired workers told FSU. Instead, call volumes had been increasing at the time they were dismissed, with CBA supposedly "scrambling"—offering staff overtime and redirecting management to join workers answering phones to keep up.

To uncover the truth, FSU escalated the dispute to a fair work tribunal, where the union accused CBA of failing to explain how workers' roles were ruled redundant. The union also alleged that CBA was hiring for similar roles in India, Bloomberg noted, which made it appear that CBA had perhaps used the chatbot to cover up a shady pivot to outsource jobs.

While the dispute was being weighed, CBA admitted that "they didn’t properly consider that an increase in calls" happening while staff was being fired "would continue over a number of months," FSU said.

"This error meant the roles were not redundant," CBA confirmed at the tribunal.

Bank apologizes, but damage is done

Now, CBA has apologized to the fired workers. A spokesperson told Bloomberg that they can choose to come back to their prior roles, seek another position, or leave the firm with an exit payment.

"We have apologized to the employees concerned and acknowledge we should have been more thorough in our assessment of the roles required," CBA's spokesperson told Bloomberg.

A Bloomberg Intelligence report from earlier this year estimated that banks globally will slash "as many as 200,000 jobs in the next three to five years" due to expectations that many tasks today will be assigned to AI in the near future. "Back office, middle office, and operations are likely to be most at risk," Bloomberg reported.

CBA's reversal shows that some banks may be tempted to rush AI initiatives and dismiss workers without thoroughly understanding the potential impacts on their business. But the backtracking hasn't seemed to slow down CBA much. Just last week, it announced a partnership with OpenAI that will "explore advanced generative AI solutions that aim to strengthen scam and fraud detection and deliver more personalized services" for its customers.

CBA did not suggest that this initiative would lead to further downsizing, claiming the bank's goal is to "invest in our people and their AI proficiency so they can better support our customers" and "embed the responsible use of AI across its workforce."

Ars could not immediately reach CBA or FSU to confirm how many workers have decided to return.

But FSU reported that for all 45 workers, "the damage has already been done."

These employees "have had to endure the stress and worry of facing redundancy" and were "suddenly confronted with the prospect of being unable to pay their bills." FSU warned that CBA's flip-flopping on AI serves as a "stark reminder to all of us that we can never trust employers to do the right thing by workers, and change can happen at any time and impact any one of us."

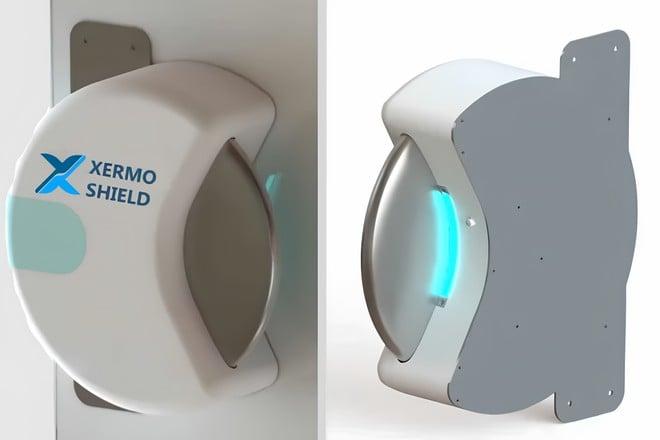

Maniglia autopulente: l'invenzione di uno studente che elimina il 99,9% dei batteri

Maniglia autopulente: l'invenzione di uno studente che elimina il 99,9% dei batteri