We all use banks—for savings, credit cards, small business loans, mortgages. But a lot of the institutions available to us do some pretty dirty business when it comes to the climate crisis.

Featured VideoAccording to a recent report called Banking on Climate Chaos, the world’s 65 largest banks have committed $7.9 trillion dollars to the fossil fuel industry since 2016. The analysis—coauthored by eight nonprofits, including the Sierra Club and finance watchdog BankTrack—found JPMorgan Chase, Citigroup, and Bank of America to be the three largest financiers of fossil fuel companies. Though the flow of cash to oil and gas was slowing down as recently as 2021, banks have regressed and increased their investments by $162.5 billion from 2023 to 2024.

Just so we’re clear: This is your money they’re spending. When you get your paycheck or stash some cash in savings, it isn’t sitting there doing nothing. The banks use those funds as liquidity to issue loans and make money off interest.

The problem? You don’t really get a say in where that money goes. “Those loans shape our entire economy,” says Zak Gottlieb, director of volunteer-run sustainable banking database bank.green. “Sadly, fossil fuel companies, for larger banks, are a big recipient. It’s your deposits, essentially, that facilitate that.” He estimates that for major U.S. banks, some 20% to 30% of loans go to carbon-intensive industries like agriculture and mining, and between 5% and 10% is straight-up fossil fuel financing.

AdvertisementNow, this isn’t to say you’re a bad guy just for having some money in one of those banks. But it is a huge opportunity for change. “The main role of civil society is to put pressure on our financial institutions,” says Valerio Micale, Associate Director of the Climate Policy Initiative. Enter green banks, which the Organisation for Economic Co-operation and Development defines as those that invest in low-carbon and resilient infrastructure and other green sectors like water and waste management.

These eco-conscious financial institutions are becoming increasingly available to customers and investors. They’re also a key for reaching the $5 trillion annual investment the U.N. says it will take to accelerate progress in areas like renewable energy and sustainable agriculture—especially as some nations fall short of their climate goals. “This is the great overlooked climate action that you as an individual can take that will, in many cases, even if you don’t have a ton of money, still have a tangible impact,” says Gottlieb.

So how do you make the switch? Let’s get into it.

Advertisement

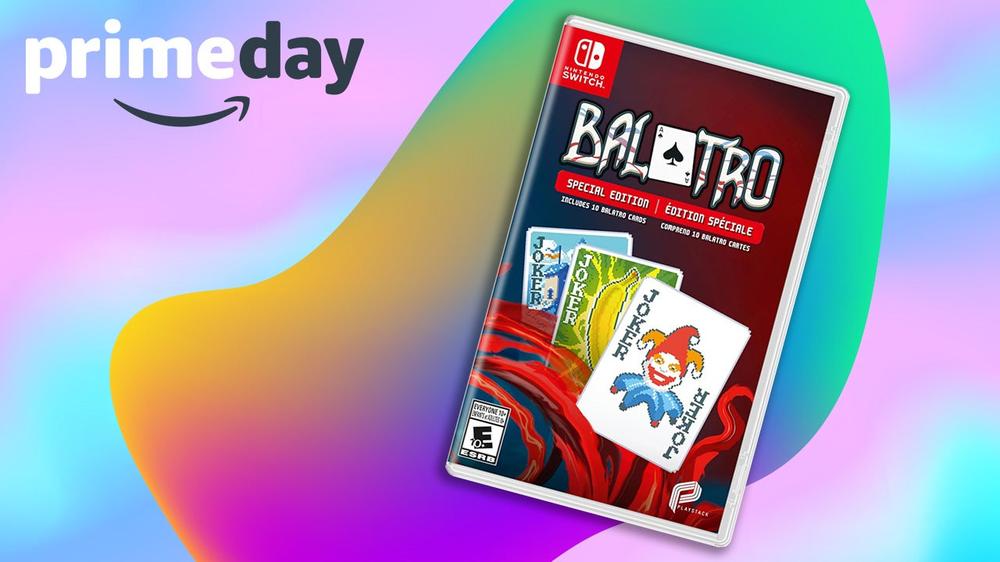

Don't Fold on This Prime Day Deal for Balatro on Nintendo Switch

Don't Fold on This Prime Day Deal for Balatro on Nintendo Switch