Get more news like this directly to your inbox every week by subscribing to our Ukraine Business Roundup newsletter.

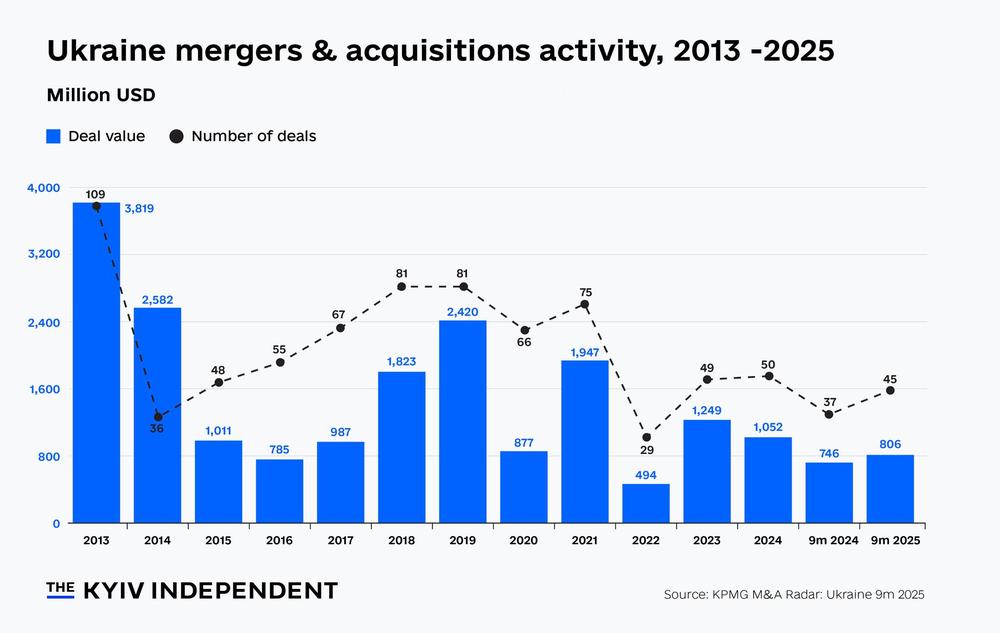

Ukraine’s merger & acquisition market has stayed active despite international investor caution, with 45 deals worth a disclosed $806 million in the first nine months of 2025, an 8% increase in value from last year, a new report from accounting firm KPMG Ukraine said.

Domestic investors drove most of the activity, accounting for 73% of transactions and $442 million in value, while outbound deals rose to $329 million as companies pursued cross-border opportunities, according to the firm. Inbound deals slowed to $35 million.

Large transactions, including poultry-producing giant MHP's purchase of a 92% stake in leading Spanish poultry and pork producer Uvesa and leading mobile operator Kyivstar's acquisition of Ukraine's popular ride-hailing service Uklon, made up more than half the disclosed deal value.

Svitlana Shcherbatyuk, head of transaction services at KPMG Ukraine, said that strong growth in IT and innovation, as well as continued activity in agriculture and defense tech, were key drivers of deal flow.

"While overall dealmaking remains constrained by wartime risks and investor caution, other traditional mainstays of the M&A landscape, such as agriculture, are also expected to define a trajectory of gradual market normalisation heading into 2026," Shcherbatyuk said.

The actual size of Ukraine's M&A market could be higher. "Limited market transparency, a common structural feature in Ukrainian dealmaking, continues to have an effect on deal disclosure data, with the share of transactions listing deal value declining from 59% in 9m 2024 to 53% in 9m 2025," the firm said in a press release.

British man arrested in Kyiv for ‘preparing to commit terrorist attacks,’ Ukraine says

British man arrested in Kyiv for ‘preparing to commit terrorist attacks,’ Ukraine says