Venmo and PayPal — two of the most popular apps for digitally sending money to friends, family, or businesses — have never been natively compatible. But according to Venmo, this is changing in November.

“Venmo users and PayPal users will be able to pay each other in the U.S. and worldwide,” Venmo wrote in an email to customers. “That means that PayPal users will be able to find and pay you using your phone number, and later using your email address.”

For years, customers have used convoluted workarounds to transfer money between the services. This has long been a pain point for users, especially since Venmo is owned by PayPal, leading users to believe this kind of feature would already exist. (Perhaps integrating the two services would discourage users from creating accounts on both platforms, disincentivizing PayPal to enable this feature sooner.)

This change means that PayPal users will now be able to find Venmo users by inputting their phone numbers, and later, their email addresses. If you don’t want PayPal users to be able to find you, you can update your settings in the Venmo app by navigating to Settings > Privacy > Find me… and while you’re at it, you might as well default your Venmo transactions to private via Settings > Privacy. You’ll thank me in the long run.

PayPal announced that it would broaden its network of payment systems in July, starting with Venmo, but the companies did not confirm the date of the update until now. This collection of partnerships, which PayPal has named PayPal World, will also work with Mercado Pago, NPCI International Payments Limited, and Tenpay Global. This will help users send money internationally without barriers and fees.

Combined, Venmo and PayPal have 2 billion global users, according to PayPal.

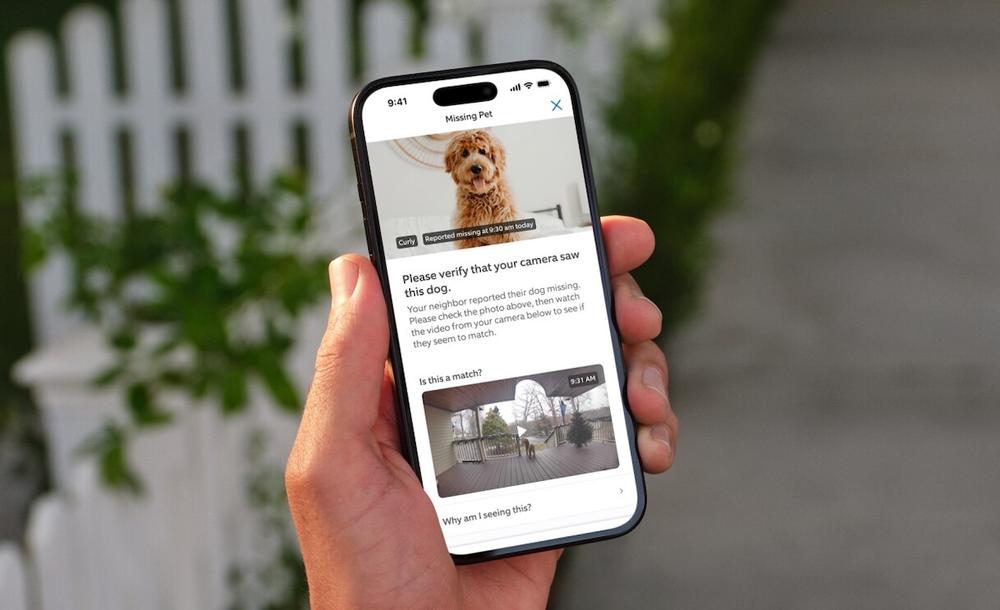

Ring cameras can now recognize faces and help to find lost pets

Ring cameras can now recognize faces and help to find lost pets